Real Estate Agent Training Hub

Real Estate Agent Training Hub

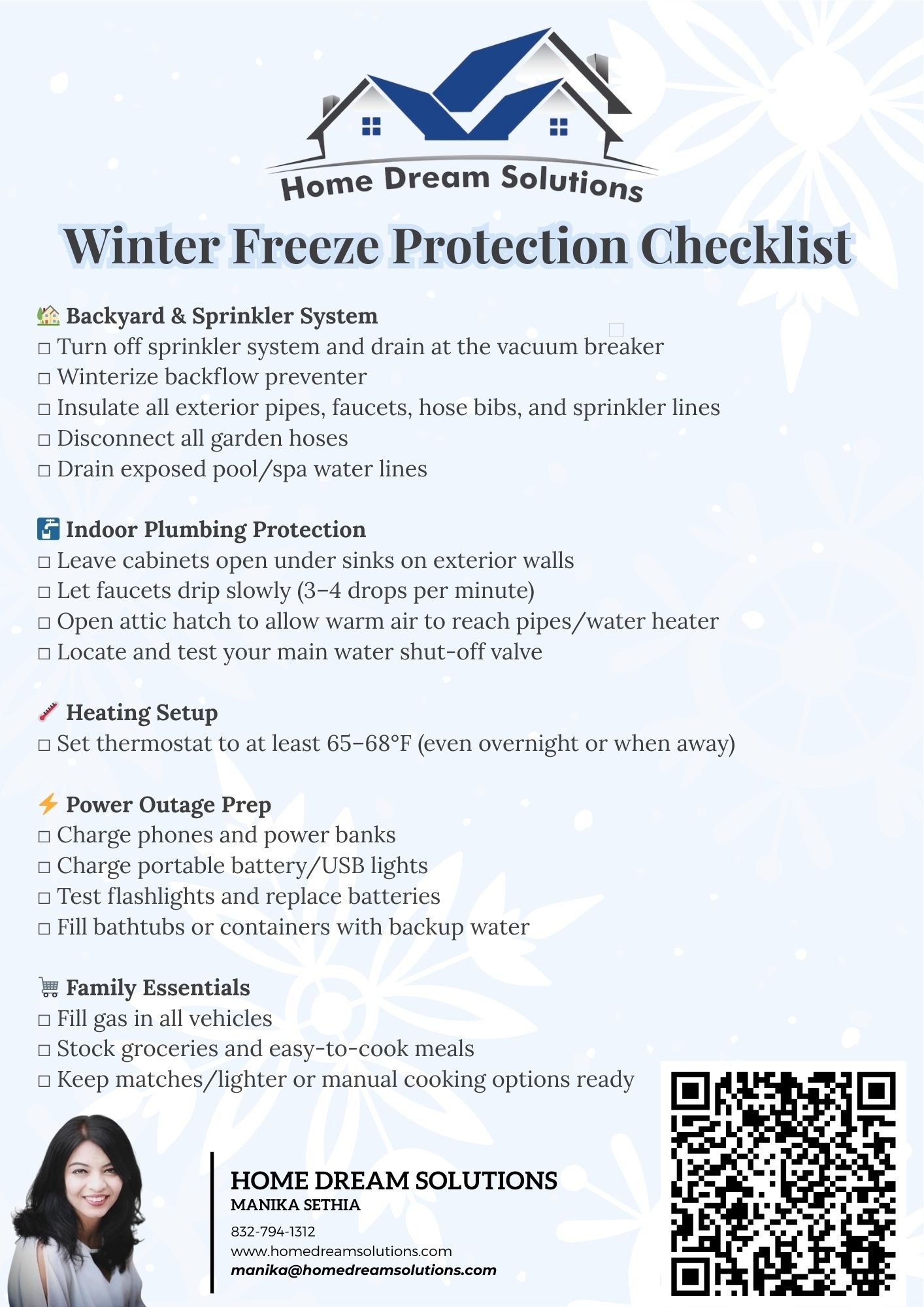

Agents waste time hunting training across 10 different places. This page is a curated, organized hub of official and high-quality training resources used across the industry—so you can learn faster, stay compliant, and build skills that actually matter.

Note: This page is not Home Dream Solutions (HDS)-specific.For HDS tools, templates, internal SOPs, and brokerage procedures, use the HDS Agent Portal.

HAR CRM Training

Learn how to manage contacts, leads, follow-ups, and communication using HAR CRM through official HAR YouTube training.

HAR Matrix Training

Learn how to use HAR Matrix for property searches, comps, listings, reports, and MLS workflows.

Kwikset Smart Lock

Step-by-step video on resetting and programming a new access code on a Kwikset smart lock for listings and rentals.

Showing Smart

Learn how to set up showing instructions, manage appointments, and communicate with agents using Showing Smart.

Supra

Learn how to access, manage, and use Supra lockboxes for listings and showings.

Dotloop

Learn how to create transactions, manage documents, collect signatures, and stay compliant using dotloop.

Read More